The meal voucher for 2022 is worth 194 CZK

The meal voucher for 2023 is worth CZK 194

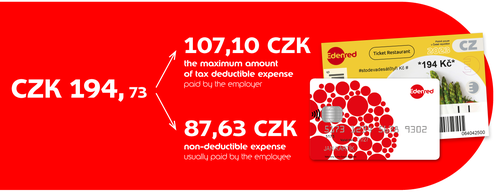

Optimal contribution for meals from the point of view of tax deductibility was determined for the year 2022 by new regulation of the Ministry of Labor and Social Affairs (No. 511/2021 Coll.), which set the new amount of the meal allowance for 2022 to CZK 153. According to the law on income tax, you can claim 70% of the value of the meal allowance listed above (but a maximum of 55% of the value of the meal voucher) as a tax deductible expense.

- Maximum tax deductible expense: 0,7*153 = 107,10 CZK

- Meal voucher value: 107,10/0,55 = 194,73 CZK

The value of the meal voucher for 2023, at which you can claim the maximum amount as a tax expense as an employer, is therefore CZK 194 (with a 55% contribution from the employer).

For many companies, meal vouchers can be one of the ways to increase employees' net income despite currently tight budgets. On the part of the employee, they are always fully exempt from taxes, social and health insurance, in (almost) any amount - even 220 CZK. In addition, the average price of lunch has risen again, so we recommend that you also increase the nominal value of meal vouchers you have ordered.

How to increase the value of meal vouchers?

Simply start ordering higher value paper or digital meal vouchers. There is no need to sign amendments to the contract or report anything to us. For the next order via the Edenred portal, select the face value of the meal voucher of 194 CZK.

More articles

The meal voucher for 2025 is worth CZK 225

Treat your employees to a full lunch for 1 meal voucher.

Higher limit for freetime benefits – more rewards, more experiences, more savings

The limit on tax-free freetime benefits for 2025 was issued Government Regulation No. 282/2024 has set a new limit for tax-free leisure benefits for 2025, which will be CZK 23,278 for the year.

The meal voucher for 2024 is worth CZK 211

Treat your employees to a full lunch for 1 meal voucher.